basic pet health insurance for planners who hate surprises

What "basic" usually means

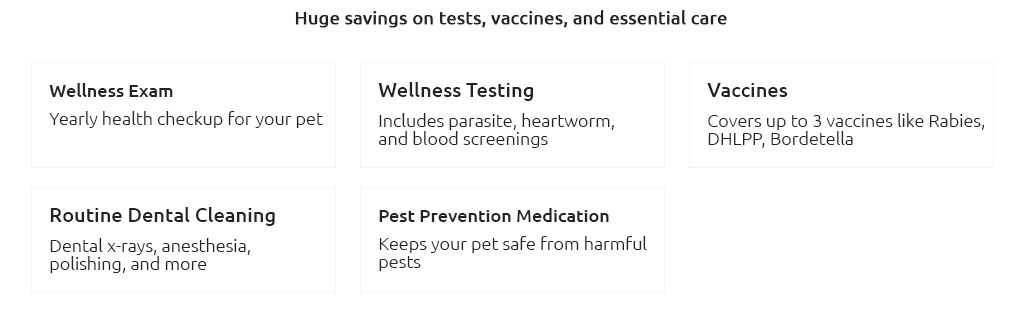

Think core protection, not every bell and whistle. Basic plans typically target accidents and common illnesses, diagnostic tests, prescriptions, and surgery, with a deductible and coinsurance that share costs between you and the insurer. Waiting periods apply. Wellness and routine care are often add-ons or excluded.

Pragmatic caveat: pre-existing conditions are almost never covered, and some breed-specific issues or bilateral conditions can be limited. Premiums tend to rise as pets age, and annual caps exist on many entry-level policies.

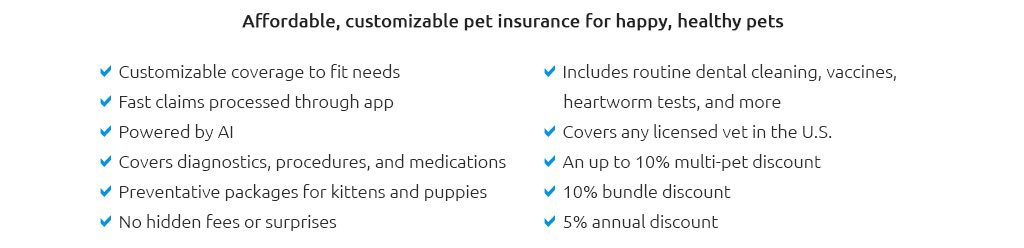

How basic differs from broader coverage

- Scope: Basic = accidents and illnesses; Comprehensive often adds rehab, behavioral therapy, and dental illness. Fewer surprises with broader plans, higher premiums too.

- Limits: Basic plans may include lower annual caps. Comprehensive options more often offer higher or unlimited caps.

- Flexibility: Most pet policies let you visit any licensed vet, but extras like direct-pay to the clinic are less common on basic tiers.

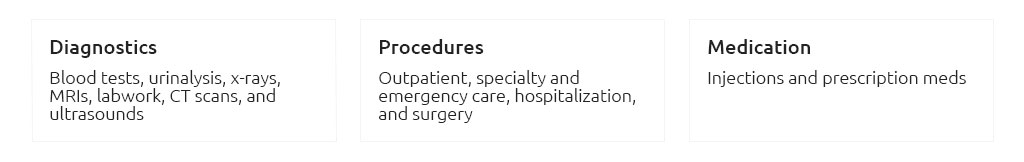

Costs and payouts, side by side

Deductibles and reimbursement

- Annual vs per-incident deductible: Annual means you meet it once per policy year; per-incident restarts for each new condition. For steady budgets, annual is easier to plan.

- Reimbursement rate: 70 - 90% is common. Lower premiums pair with lower reimbursement. Balance what you can pay at the visit versus over the year.

- Benefit caps: Look for clear annual limits, per-condition caps, and any lifetime ceiling. Caps shape your true risk protection over many years.

What a claim can look like

Rainy Tuesday, your terrier slips and tears a cruciate ligament. The surgery estimate is $3,500. With a $250 annual deductible, 80% reimbursement, and a $5,000 annual limit, you might pay $250 deductible plus 20% of the remainder; roughly $950 out of pocket, about $2,550 reimbursed - assuming the condition isn't excluded and the waiting period has passed.

Small but important detail: most insurers reimburse after you pay the vet. Direct-pay depends on the clinic and the insurer's setup, so ask your vet in advance if same-day payment is essential for you.

Reliability under the hood

- Claims track record: Consistent turnaround times matter when you're staring at a post-op bill. Look for multi-year stability, not one-off promotions.

- Underwriter strength: Policies backed by established carriers tend to handle big claim years better.

- Clear exclusions: Read sample policies. Reliable providers state dental, hereditary, and chronic condition rules in plain language.

- Support at odd hours: 24/7 claim portals and helplines aren't fluff when something happens on a holiday.

Where a basic plan shines - and where it doesn't

- Shines: New pets, accident-prone explorers, families building a safety net without paying top-tier premiums.

- Falls short: Chronic, complex conditions over many years, extensive rehab, or dental illness - these often need broader coverage or add-ons.

Long-term view: keeping the math honest

- Estimate expected vet costs for your pet's breed and age across five to ten years.

- Compare the sum of premiums plus typical out-of-pocket costs against worst-case vet bills you could not comfortably cover.

- Revisit annually. As pets age, caps, premiums, and your own cash buffer may shift the right choice.

Questions to compare before you commit

- Is the deductible annual or per-incident, and can I change it later?

- What exactly counts as pre-existing or bilateral, and how is "curable" defined?

- Any reimbursement limits by condition or by invoice line item?

- Average claims processing time over the last year?

- Can my vet submit claims directly, and is direct-pay possible?

Practical next steps

Gather two or three sample policies, note the caps, deductible type, and reimbursement rate, and run the same scenario through each - like that $3,500 knee surgery - to see real differences. If your vet team has experience filing with certain insurers, that's useful, not decisive. The most reliable plan is the one you understand well enough to use without second-guessing on a stressful day.